Criteria Brain

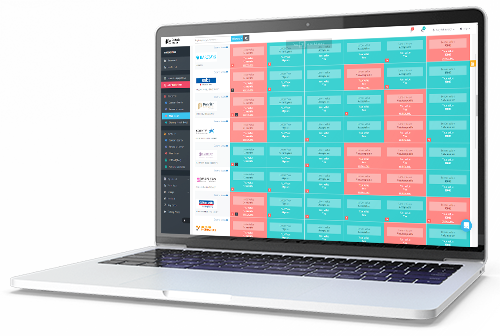

Why source criteria one at a time when you could be sourcing up to six simultaneously from over 90 lenders? Criteria Brain is your tool for combating the ever-increasing number of complicated cases that eat into your day and demand your time.

Why Criteria Brain

Criteria Brain is smart, reliable tech with verified data. Helps mortgage brokers boost their speed, efficiency and client care.

Search in seconds

Compare up to six different criteria categories at the same time

Verified criteria

Reliable, up-to-date and accurate data from over 90 mortgage lenders across the UK

Comprehensive data

Searches through over 75,000 individual criteria from lenders for Residential and Buy to Let mortgages

Criteria Brain Key Features

Our technology is a game-changer. Giving you reliable data in seconds so you can provide your clients with tailored product options.

- Search and compare up to six different criteria categories such as employment, income, age, adverse and interest-only mortgages in one go.

- Reliable, up-to-date and verified information from over 90 mortgage lenders

- Fully integrates with Sourcing Brain and Affordability Brain platforms for ease of use

- Searches through over 75,000 individual criteria for Residential and Buy to Let mortgages

- Tailor searches by flagging critical or deal-breaker criteria

Find the best solutions for head-scratching mortgage challenges with Criteria Brain. Start your 30-day free trial today.

testimonials

FREQUENTLY ASKED QUESTIONS

If you can't find the answer you're looking for contact us via live chat, email or phone

Products for intermediaries

Sourcing Brain

Online product sourcing

- Free Hometrack AVM integration

- Research multiple scenarios

- Powerful integrations

The Key

Simple and compliant CRM platform

- Online customer fact find

- Save up to an hour per case

- Easy compliance

Criteria Brain

Save time on complex cases

- Search six criteria at a time

- Data verified by lenders

- Search over 75,000 criteria

Affordability Brain

Speedy affordability sourcing

- Submit to 36 lenders simultaneously

- Amend and re-run searches

- Automatic audit trails

Submissions Brain

Multi-lender submissions gateway

- Submit to nine lenders simultaneously

- Minimise rekeying

- Save and return to forms

Web Brain

Engaging website plug-ins

- Increase website engagement

- Generate leads

- Plug-ins automatically update